Do Easements Devalue Property? What Every Landowner Should Know

Easements are a common but often misunderstood part of landownership in Texas and across the country. Whether it’s a utility company installing a power line, a pipeline operator laying infrastructure underground, or a government agency creating access roads, easements can significantly alter the use and marketability of rural land.

Many landowners assume that because they receive a payment for granting an easement, the impact on their property is covered. But the truth is more complicated and potentially costly. While the immediate compensation can appear fair on the surface, it is critical to understand that these agreements may have serious long-term consequences that extend far beyond the financial terms.

Understanding easements how they work, their different forms, and the nuances of property rights is essential for preserving land value and making informed decisions as a landowner. From minor visual impacts to complete loss of development rights, the range of easement consequences is broad and often underestimated. Educating yourself now can save you thousands if not tens of thousands in lost property value down the road.

The Hard Truth: Easement Payments Don’t Offset Market Value Losses

When a utility company offers you money for a transmission line or pipeline easement, the check may feel like fair compensation. But multiple studies show that easement payments rarely reflect the full devaluation of the property as a whole.

These agreements often:

- Reduce your usable acreage

- Lower resale interest and marketability

- Create permanent restrictions on development

- Visually and environmentally degrade the land

- Introduce perceived or actual safety risks

- Impact hunting, grazing, and leasing income potential

In other words, you might be paid for the easement strip itself but your entire property could lose long-term value far beyond that strip. Even worse, these losses are not always obvious until it’s time to sell the property, develop it, or refinance.

Some landowners accept an easement thinking it’s a small price for minor inconvenience, only to discover years later that a future buyer refuses to purchase the land or insists on a major price reduction because of the easement.

What the Research Says: Real Devaluation Data

1. High-Voltage Transmission Lines: Up to 45% Loss

A study of over 5,400 vacant lots in South Carolina found that properties directly adjacent to high-voltage power lines lost an average of 44.9% in value, while those 1,000 feet away still saw a 17.9% decline mainly due to visual impact, noise, and buyer hesitations around health risks (source). These lines can also interfere with aerial applications, agricultural operations, and wildlife movement.

In 2015, a Wichita County jury found a 345 kV transmission line easement cut a North Texas property’s value and awarded $393,165 in damages. On Feb. 12, 2015, the court entered a $445,365 judgment with interest and costs. Oncor Electric Delivery took a 33.6 acre, 160 foot by 1.7 mile easement across land near Burkburnett after offering less than $55,000, then nearly $140,000. The case reinforces your right to seek damages for lost value to the remainder of your land, not only the strip inside the easement. For the article go here – LINK

2. Conservation Easements: 35%–65% Value Reduction

Conservation easements are legal agreements that permanently limit the use of land to protect its conservation values. While they can be beneficial for the environment and provide tax incentives, they often restrict development potential. According to a Journal of Forestry study, properties under conservation easements see a 35% to 65% drop in value because of limitations on subdivision, construction, or commercial activity (source). This can make the land less attractive to potential buyers or investors.

3. Gas Pipelines & Utility Easements: Variable But Significant

A 2017 study using hedonic pricing methods found that utility easements like gas and oil pipelines cause meaningful reductions in property value especially when they interfere with surface use or pass near homesites. These pipelines come with environmental and safety concerns that can scare off potential buyers. The closer and more invasive the easement, the greater the loss (source).

4. Marketability vs. Compensation

What these studies show clearly is that buyer perception often drives land value. Even if an easement doesn’t physically interfere with a home or ranch operation, it can psychologically impact buyers, who may walk away or demand a discount due to aesthetic, safety, or legal concerns. This is especially true for recreational land buyers, luxury estate builders, and investors who are sensitive to limitations on use or long-term liability.

In many rural real estate transactions, disclosure of an easement is enough to kill a deal even if the easement itself occupies a small portion of the land. That speaks volumes about how damaging they can be to perceived value.

Ranking the Impact of Different Easements on Property Value

| Easement Type | Typical Market Impact |

|---|---|

| High-Voltage Transmission Lines | Up to 45% loss (adjacent), ~18% (within 1,000 feet) |

| Conservation Easements | 35%–65% loss due to restricted development rights, although tax credits present |

| Gas & Oil Pipelines | Moderate to high loss, depending on visibility and access |

| Access Roads & Utility Corridors | 5%–15% reduction due to loss of privacy or usability |

| Standard Residential Electric Poles | Minimal impact, unless near homesite or scenic views |

It’s important to note that multiple easements can stack in their negative effects. For example, a property with a gas pipeline, a utility road, and a power line may be significantly less valuable than a similar parcel without them even if each individual easement was compensated.

Why This Matters for Texas Landowners

In Texas, landowners have certain protections when approached with an easement request, but eminent domain law allows utility companies to force an easement if negotiations fail. That’s why it’s critical to understand your rights and the real financial impact from the start.

Landowners can and should negotiate for:

- Full market value loss (not just land used)

- Damage to remaining property (remainder damages)

- Placement terms, access control, and restoration obligations

- Legal costs, appraisal fees, and survey expenses

- Ongoing access restrictions and environmental restoration

Texas also allows for group representation. Landowners facing large-scale transmission or pipeline projects may benefit from joining together with neighbors to negotiate better terms, ensure transparency, and secure collective legal support. This can often result in higher compensation and better protection.

Before You Sign: What Every Landowner Should Do

If you’ve been approached about granting an easement, follow these steps:

- Hire a land attorney or easement valuation specialist

– Preferably one familiar with Texas eminent domain and rural land impacts. - Get a professional “before and after” appraisal

– This measures total property value change, not just the narrow strip. - Consider the long-term implications

– Will it affect resale? Hunting leases? Future development or subdivision? - Compare your land to recent comps with and without easements

– Marketability suffers more than sellers realize. - Document everything in writing

– Don’t rely on verbal promises from utility reps or contractors. - Ask for clarity on future use rights

– Will you still be able to build fences, graze livestock, or hunt on the easement area? - Negotiate for restoration and cleanup guarantees

– This is crucial for pipelines and underground infrastructure. - Know your timeline

– Easement projects can take months or even years. Plan accordingly.

Don’t Let a One-Time Check Cost You Thousands Later

Even if a utility offers a seemingly generous payment, you could be sacrificing far more in equity, flexibility, and future land value. Easement agreements can last decades or permanently making your land harder to sell, harder to finance, or less attractive to heirs.

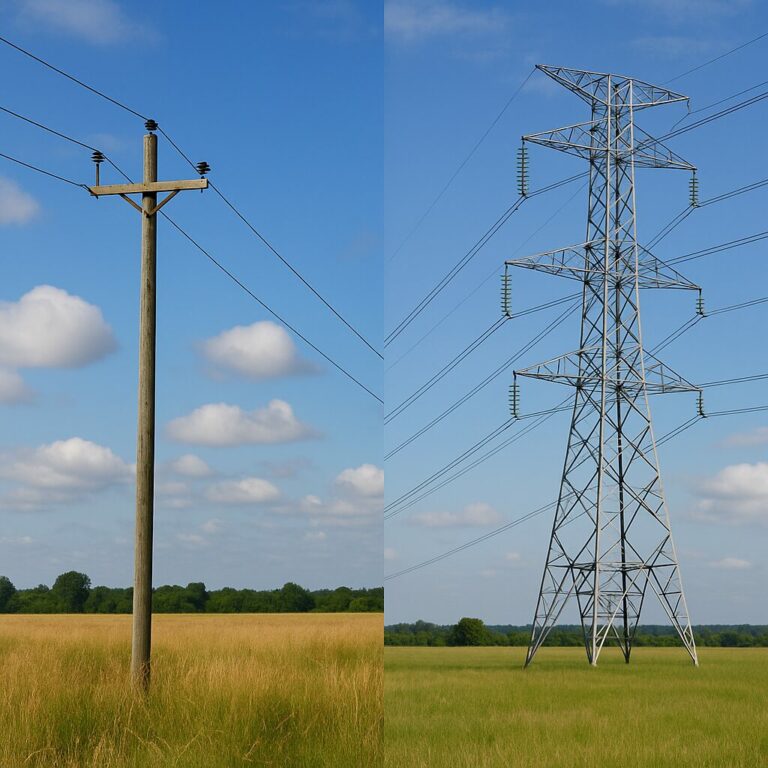

A simple power pole may not matter much but a transmission line or pipeline can permanently limit what your land is worth and how it can be used.

What seems like a fair payment today may pale in comparison to a price reduction during resale negotiations, or the inability to develop your land the way you want.

Final Thoughts

Easements can be a lifelong liability on your property. Whether you’re selling a Texas ranch, holding land for investment, or simply preserving your legacy, you must weigh the long-term costs against the short-term compensation. The easement may serve someone else’s agenda but its consequences will affect you and your family for generations.

Don’t let the easement be the reason your land sells for less or doesn’t sell at all.

Need Help Navigating an Easement or Protecting Your Land Value?

James Bigley Ranches works with Texas landowners facing easement challenges and utility negotiations. Contact us today for guidance, trusted referrals, and local expertise on protecting your land’s long-term value.

Frequently Asked Questions About Easements and Property Value

Q1: Do easements lower property value?

A: Yes, easements can significantly reduce property value—especially when they restrict land use, affect aesthetics, or raise safety concerns. High-voltage transmission lines, gas pipelines, and conservation easements are known to cause the greatest devaluation, sometimes by as much as 45% or more.

Q2: If I’m paid for an easement, does that cover the loss in value to my land?

A: Not necessarily. In most cases, easement compensation only covers the specific strip of land used, not the broader impact on your entire property’s resale value, usability, or market appeal.

Q3: Which types of easements cause the most damage to land value?

A: From most to least devaluing:

- High-voltage transmission lines (up to 45% loss)

- Gas and oil pipelines

- Conservation easements (35%–65% loss)

- Utility access roads or corridors

- Standard electric poles (minimal impact unless intrusive)

Q4: Can I negotiate the terms of an easement in Texas?

A: Yes. While utility companies can use eminent domain, you still have the right to negotiate for:

- Total market value loss

- Damage to remaining land (remainder damages)

- Access control and placement

- Legal and appraisal fees

Q5: What is “remainder damage” in an easement case?

A: “Remainder damage” refers to the diminished value of the property that’s not directly used by the easement, but still negatively affected such as loss of privacy, access restrictions, or reduced development potential.

Q6: Are there studies proving that easements reduce property value?

A: Yes. For example:

- A South Carolina study found up to 45% value loss from proximity to transmission lines.

- Research in the Journal of Forestry shows conservation easements cause 35%–65% reductions.

- Hedonic pricing studies confirm that pipelines and corridors impact market value based on usability and perception.

Q7: What should I do if a utility company contacts me about an easement?

A: Before signing anything:

- Consult a land attorney

- Get an independent appraisal

- Document all communication

- Understand your long-term goals for the land

Q8: Can easements affect my ability to sell or develop land in the future?

A: Absolutely. Easements can limit:

- Subdivision potential

- Homesite placement

- Hunting or grazing leases

- Buyer pool and resale value

Keywords: easement property value, do easements lower land value, transmission line easement, gas pipeline easement, landowner rights, utility easement impact, Texas land devaluation, rural property easements, real estate easement disclosure