Legal Checklist for Ranch Investments

In ranch investments, legal considerations are the bedrock upon which successful transactions and operational endeavors are constructed. Ranching ventures are not merely about land and livestock; they are intricate legal enterprises entwined with property rights, regulatory frameworks, and contractual obligations. This essay explores the profound significance of legal considerations within the realm of ranch investments, shedding light on their pivotal role in shaping the trajectory of such ventures. Additionally, it delineates the objectives of a comprehensive legal checklist meticulously crafted for discerning ranch owners and astute investors navigating the complex terrain of ranching enterprises.

Legal considerations permeate every facet of ranch investments, exerting an omnipresent influence from initial property acquisition to daily operations and eventual divestment. The multifaceted nature of land ownership and usage rights inherent in ranch properties underscores the criticality of comprehending the legal landscape.

With a proper understanding of legal intricacies, investors can avoid encountering unforeseen obstacles that could thwart their objectives or expose them to potential legal entanglements. Moreover, legal considerations in ranch investments transcend mere adherence to regulatory mandates; they encompass proactive risk management, asset safeguarding, and strategic long-term planning.

By preemptively addressing legal dimensions, ranch investors can fortify their positions, mitigate risks, and optimize the value proposition of their investments over time. A meticulously crafted legal checklist for ranch investments has manifold objectives, each aimed at fortifying the investor’s position and ensuring robust legal standing throughout the investment lifecycle. These objectives encompass: Through an in-depth exploration of these legal nuances, investors and ranch owners can effectively equip themselves with the knowledge and understanding to navigate the intricate legal landscape of ranching enterprises.

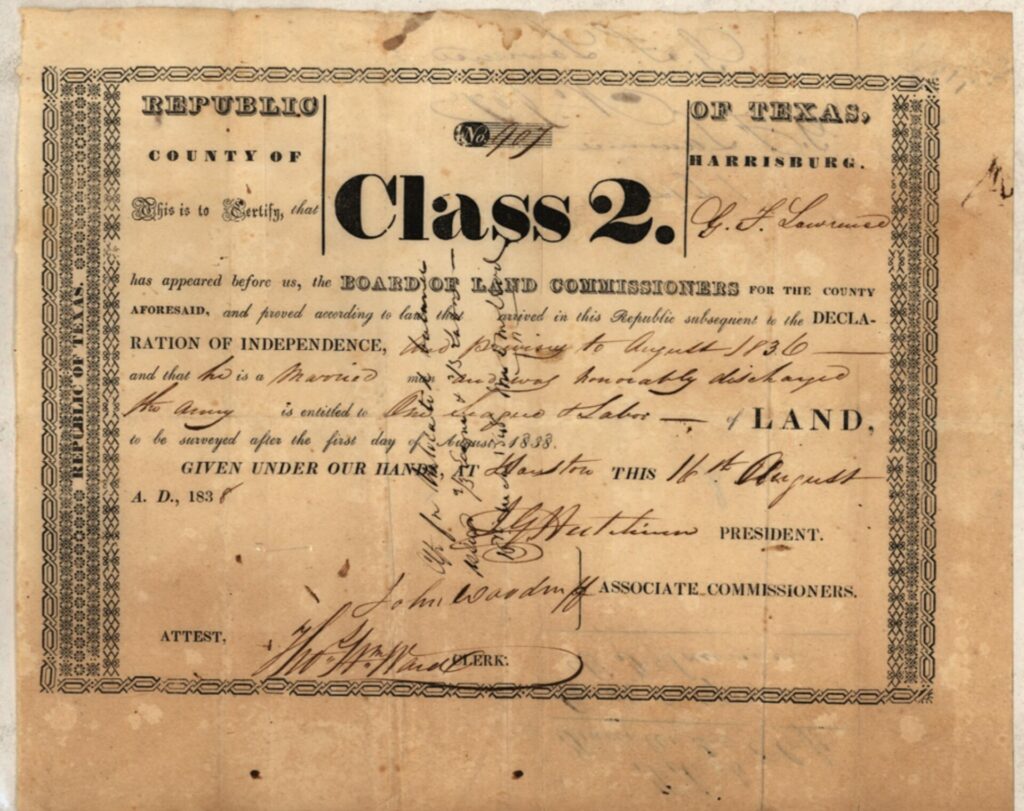

Property Ownership and Title

Property ownership and title are foundational to ranch investments, representing the legal basis for ownership rights and land usage. This section explores critical considerations related to property ownership and title verification.

Verification of Property Title

Verifying property title is a critical step in the due diligence process for ranch investments. It involves thoroughly examining historical records, title deeds, surveys, and property legal descriptions to confirm the legal ownership status of the ranch property. This verification process helps identify discrepancies, errors, or clouds on the title that may affect the property’s marketability or future transactions.

Clearing Encumbrances and Liens

Encumbrances and liens can significantly impact the value and marketability of ranch properties. As part of the title verification process, it’s essential to identify and clear any encumbrances or liens against the property, such as mortgages, easements, or tax liens. Clearing these encumbrances ensures the property’s title is free and clear, enhancing its marketability and reducing legal risks for investors.

Boundary Surveys and Property Lines

Boundary surveys are crucial for defining property lines and resolving potential boundary disputes. Conducting a boundary survey involves hiring a professional surveyor to accurately measure and map the physical boundaries of the ranch property based on legal descriptions and survey data. By confirming property lines through boundary surveys, ranch investors can avoid disputes with neighboring landowners and ensure they have legal access to their property.

Ranch investors must address legal considerations related to property ownership and title verification to mitigate risks, ensure compliance, and protect their investments. By conducting thorough due diligence, clearing encumbrances and liens, and verifying property boundaries, investors can establish a solid legal foundation for their ranch investments and pave the way for long-term success.

Water Rights and Access

Assessment of Water Rights

Assessing water rights is paramount for ranch owners, as it delineates their entitlement to utilize water resources for various purposes, including irrigation, livestock watering, and recreational activities. Conducting a comprehensive assessment involves verifying water rights documentation, determining priority dates, and ascertaining the quantity and quality of water available for appropriation. This assessment provides crucial insights into the ranch’s water allocation capabilities and potential constraints, enabling informed decision-making regarding water management strategies and resource utilization.

Riparian Rights and Access

Riparian rights grant landowners adjacent to water bodies the privilege to use water for domestic, agricultural, and recreational purposes. Understanding riparian rights is essential for ranch owners near streams, rivers, or lakes, as it governs their access to water and establishes their obligations to preserve riparian ecosystems. By comprehending the scope and limitations of riparian rights, ranch owners can navigate water usage regulations, resolve disputes with neighboring landowners, and sustainably manage water resources to uphold ecological balance and compliance with legal mandates.

Water Usage Agreements and Restrictions

Navigating water usage agreements and restrictions is a critical aspect of water management for ranch owners. These agreements may include contracts with irrigation districts, water districts, or governmental agencies outlining terms of water allocation, usage limitations, and compliance obligations. Additionally, regulatory restrictions, such as groundwater pumping regulations or water conservation mandates, impose constraints on water usage and necessitate adherence to specified guidelines. By negotiating favorable water usage agreements and adhering to regulatory requirements, ranch owners can secure reliable water access and mitigate legal conflicts or penalties associated with non-compliance risks.

Environmental Compliance

Environmental Impact Assessment

Conducting environmental impact assessments is essential for ranch owners to evaluate the potential ecological implications of their operations and comply with regulatory requirements. These assessments encompass identifying and mitigating adverse environmental effects, such as soil erosion, water pollution, habitat destruction, or wildlife displacement. By assessing ecological impacts proactively, ranch owners can implement mitigation measures, secure permits, and demonstrate compliance with environmental regulations, thereby minimizing legal liabilities and preserving ecological integrity.

Endangered Species Protections

Protecting endangered species is a legal imperative for ranch owners, particularly those in ecologically sensitive areas harboring threatened or endangered wildlife. Compliance with endangered species protections entails adhering to federal and state regulations, such as the Endangered Species Act, which prohibits activities that may harm or disrupt the habitats of listed species. Ranch owners must conduct habitat assessments, implement conservation measures, and obtain permits for activities that may impact protected species to avoid legal repercussions and foster biodiversity conservation.

Compliance with Conservation Regulations

Complying with conservation regulations is fundamental for ranch owners to manage natural resources and protect sensitive ecosystems sustainably. These regulations may encompass land conservation easements, wetland preservation ordinances, or watershed protection initiatives to conserve natural habitats and preserve water quality. By embracing conservation practices, ranch owners can enhance environmental stewardship, secure regulatory approvals, and foster community goodwill, positioning their ranches as exemplars of sustainable land management and environmental responsibility.

Taxation and Financial Obligations

Property Tax Assessment

Understanding property tax assessment methodologies and obligations is essential for ranch owners to manage their financial liabilities and optimize tax efficiencies. Property taxes constitute a significant economic burden for ranches, necessitating diligent record-keeping, valuation assessments, and compliance with tax reporting requirements. By leveraging available tax exemptions, deductions, and deferral strategies, ranch owners can minimize their property tax burdens and allocate financial resources more effectively towards operational needs and investment opportunities.

Agricultural Exemptions

In the United States, agricultural exemptions are tax benefits provided to landowners who use their land for agricultural purposes, such as farming, livestock, and timber production. These exemptions aim to reduce property taxes by lowering the assessed value of the land based on its agricultural use rather than its market value. To qualify, landowners must meet specific criteria, including demonstrating that the land is actively and primarily used for agriculture. Requirements and benefits vary by state, but generally, the land must be used for agriculture for a certain number of years. Applications are typically submitted to local tax authorities with necessary documentation to prove agricultural use, offering substantial financial relief to farmers and ranchers.

Setting up a 1-D-1 Wildlife Management plan for Texas property involves several steps to achieve Wildlife Evaluation status, which can significantly reduce property taxes, an alterative to regular ag exemption in the State of Texas for landowners. For example, a 250-acre ranch without an exemption might cost $5000 annually, whereas with an exemption, it could be less than $200. To apply, the property must already be ag or timber exempt. Owners can either wait for the County Appraisal District (CAD) to send the annual appraisal notice or proactively contact CAD to update information. Applications, including a wildlife management plan, must be submitted by April 30th each year. This status allows properties appraised as agricultural or timber lands to be converted based on wildlife management criteria.

Capital Gains Tax Implications

Navigating capital gains tax implications is crucial for ranch owners involved in property transactions or asset divestment. Capital gains taxes apply to profits earned from selling capital assets, including ranch properties. They may vary depending on holding periods, depreciation recapture, and tax-deferred exchange provisions. By consulting tax advisors, implementing tax planning strategies, and leveraging available exemptions or deferral mechanisms, ranch owners can optimize their tax outcomes and preserve a significant portion of their investment proceeds for future endeavors.

Financial Reporting Requirements

Complying with financial reporting requirements is a fundamental aspect of financial management for ranch owners, ensuring transparency, accountability, and regulatory compliance. Ranch operations entail financial transactions, asset acquisitions, and debt obligations that necessitate accurate record-keeping, financial statement preparation, and tax reporting. By adhering to Generally Accepted Accounting Principles (GAAP) and regulatory standards, ranch owners can facilitate financial transparency and stakeholder trust and mitigate risks of legal disputes or regulatory sanctions associated with non-compliance.

Contracts and Agreements

Purchase Agreements and Contracts

Executing purchase agreements and contracts is a pivotal step in property transactions for ranch owners, delineating rights, obligations, and terms of sale between parties. These agreements encompass provisions related to property conveyance, purchase price, financing terms, and contingencies, requiring meticulous drafting, negotiation, and execution. By engaging legal counsel, conducting due diligence, and ensuring compliance with contract terms, ranch owners can safeguard their interests, mitigate transaction risks, and facilitate seamless property acquisitions conducive to their investment objectives.

Lease Agreements for Grazing or Farming

Negotiating lease agreements for grazing or farming activities is essential for ranch owners seeking to optimize land utilization, generate additional revenue streams, or foster collaborative partnerships with tenants. These agreements outline lease terms, rental rates, land use restrictions, and maintenance responsibilities, necessitating clear communication, mutual understanding, and legal documentation. By drafting comprehensive lease agreements, addressing potential disputes, and establishing mutually beneficial relationships with lessees, ranch owners can optimize land productivity, maximize rental income, and foster long-term tenant satisfaction.

Employment Contracts and Labor Regulations

Navigating employment contracts and labor regulations is critical for ranch owners to ensure compliance with labor laws, mitigate employment-related risks, and foster positive workplace environments. Employment contracts delineate terms of employment, compensation packages, job responsibilities, and termination procedures, requiring adherence to legal requirements and industry standards. By implementing fair labor practices, providing employee training, and cultivating a workplace safety and respect culture, ranch owners can attract and retain qualified personnel, mitigate risks of labor disputes or regulatory violations, and uphold ethical standards in employment relations.

Estate Planning and Succession

Estate Planning for Ranch Assets

Conducting estate planning for ranch assets is imperative for ranch owners to preserve wealth, facilitate asset transfer, and mitigate tax liabilities across generations. Estate planning strategies encompass wills, trusts, and probate avoidance mechanisms tailored to individual preferences, family dynamics, and asset distribution objectives. By engaging estate planning professionals, implementing tax-efficient structures, and articulating succession intentions, ranch owners can ensure seamless asset transition, minimize probate costs, and preserve ranch legacies for future generations.

Succession Planning for Family-Owned Ranches

Facilitating succession planning for family-owned ranches is essential for preserving familial harmony, operational continuity, and generational wealth accumulation. Succession planning involves grooming successors, transferring management responsibilities, and articulating ownership transition strategies to mitigate family conflicts, business disruptions, or asset dissipation risks. By fostering open communication, setting clear expectations, and documenting succession plans, ranch owners can facilitate smooth leadership transitions, nurture family cohesion, and sustain the long-term viability of family-owned ranch enterprises.

Trusts and Probate Considerations

Utilizing trusts and probate avoidance strategies is integral to estate planning for ranch owners seeking to streamline asset transfer and minimize probate costs. Trusts offer flexibility, privacy, and asset protection benefits, enabling ranch owners to dictate asset distribution, reduce tax liabilities, and preserve family wealth.

Probate avoidance mechanisms, such as joint tenancy, beneficiary designations, or transfer-on-death deeds, bypass probate proceedings, expedite asset transfer, and reduce administrative burdens. By leveraging trusts and probate avoidance strategies, ranch owners can facilitate seamless estate settlement, preserve privacy, and mitigate legal complexities associated with probate administration.

Risk Management and Liability

Liability Insurance Coverage

Securing liability insurance coverage is essential for ranch owners to mitigate risks of legal liabilities, property damage, or personal injury claims arising from ranch operations. Liability insurance policies encompass general liability, property damage, livestock mortality, and worker’s compensation coverage, shielding ranch owners from financial losses and legal expenses associated with lawsuits or adverse events. By assessing insurance needs, selecting appropriate coverage options, and maintaining adequate policy limits, ranch owners can safeguard their assets, protect against unforeseen liabilities, and foster financial resilience in the face of legal risks.

Risk Assessment for Natural Disasters

Conducting risk assessments for natural disasters is critical for ranch owners to identify vulnerabilities, implement mitigation measures, and prepare emergency response plans to safeguard life and property. Natural disasters, such as wildfires, floods, hurricanes, or droughts, pose significant risks to ranch operations, necessitating proactive risk management strategies, such as hazard mapping, evacuation planning, and asset protection measures. By evaluating disaster risks, implementing risk reduction measures, and maintaining emergency preparedness, ranch owners can minimize potential losses, enhance operational resilience, and expedite recovery efforts in the aftermath of catastrophic events.

Legal Protection for Personal Injury Claims

Securing legal protection against personal injury claims is paramount for ranch owners to shield themselves from liability exposure and litigation risks associated with accidents or injuries on their premises. Personal injury claims may arise from slip-and-fall accidents, animal-related incidents, or equipment malfunctions, necessitating robust liability waivers, indemnification agreements, and insurance coverage. By implementing safety protocols, posting warning signs, and obtaining informed consent from visitors or guests, ranch owners can mitigate risks of personal injury claims, preserve financial resources, and safeguard their reputations in the event of legal disputes.

Conclusion

Navigating the intricate legal landscape of ranch investments demands meticulous attention to diverse legal considerations spanning water rights and access, environmental compliance, taxation and financial obligations, contracts and agreements, estate planning and succession, risk management, and liability mitigation.

By adhering to a comprehensive legal checklist tailored for ranch investments, investors and ranch owners can ensure compliance with legal mandates, safeguard their interests, and foster sustainable and resilient ranching enterprises. Informed decision-making and proactive legal planning are indispensable for navigating the complex legal terrain of ranch investments, optimizing outcomes, and realizing long-term success and prosperity in the ranching industry.

Complete Guide to Buying a Ranch in Texas

Complete Guide to Buying a Ranch in Texas Introduction Texas is home to some of the largest and most diverse ranches in the United States.

Screwworm: What Ranchers Need to Know

Screwworm: What Ranchers Need to Know (Updated 9/22/2025) For live mapping of screwworm cases go here – MAPPING The New World screwworm has returned to the

Do Easements Devalue Property? What Every Landowner Should Know

Do Easements Devalue Property? What Every Landowner Should Know Easements are a common but often misunderstood part of landownership in Texas and across the country.

Choosing the Best Ranch Location

Choosing the Best Ranch Location A ranch location refers to the geographic area where a ranch is situated. It encompasses the land, natural surroundings, and

Warthogs in Texas Where Theyre Roaming Free and Why It Matters

Warthogs in Texas: Where Theyre Roaming Free and Why It Matters Warthogs in Texas: Where Theyre Roaming Free and Why It Matters Once limited to

Unlocking Opportunity: What Real Estate Agents Need to Know About the Carbon Market

Unlocking Opportunity: What Real Estate Agents Need to Know About the Carbon Market Keywords: carbon markets, real estate agents, soil carbon sequestration, carbon credits, ranch